UPDATE NEW VAT RULES FROM EU AND OTHER COUNTRIES AFTER 1 JULY 2021

Quick Summary:

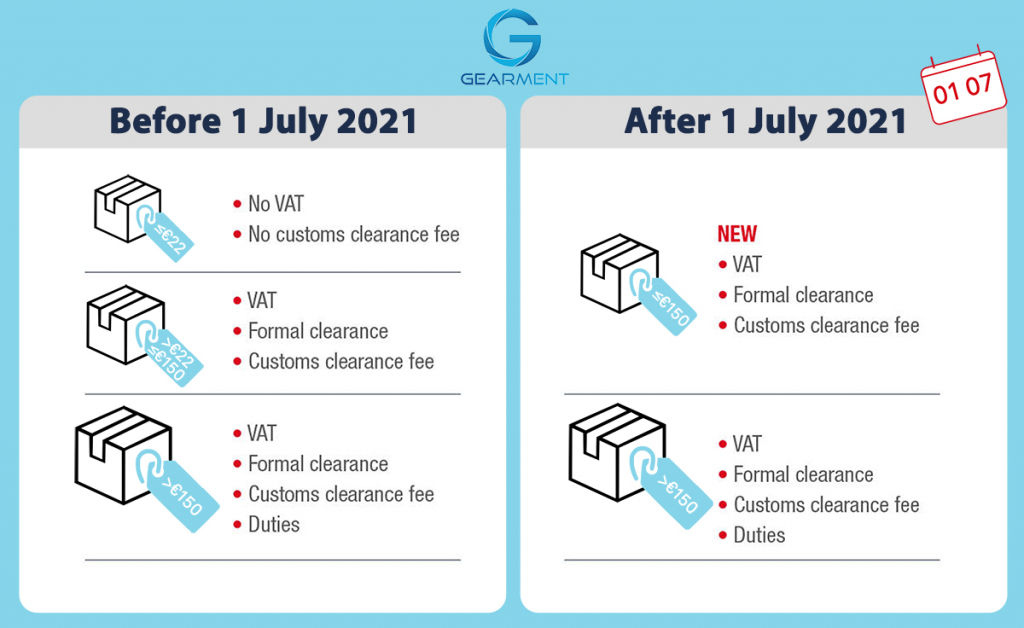

The commercial goods imported to the EU were not imposed VAT basing on the VAT rules applicable up until July 1, 2021. The low-value consignment VAT exemption was intended to promote international trade and to reduce customs from the burden of checking large volumes of packages for small amounts of potential tax revenues. However, on […]

The commercial goods imported to the EU were not imposed VAT basing on the VAT rules applicable up until July 1, 2021. The low-value consignment VAT exemption was intended to promote international trade and to reduce customs from the burden of checking large volumes of packages for small amounts of potential tax revenues. However, on July 1, 2021, the exemption was abolished, and the EU has introduced new VAT rules to decrease the VAT losses and ensure fair competition for EU businesses. Gearment will thoroughly explain about these new VAT rules and give out some solutions to help you keep doing business in the EU.

What’s new under new EU VAT rules?

Based on new VAT rules in the EU, as of July 1, 2021, all commercial goods, regardless of value, imported from a third country or third territory (including the UK) to the EU have to be EU VAT charged and formal customs declaration registered. Even if you are using third-party fulfillment services, such as Fulfillment by Amazon, all transactions will subject to VAT.

There are two options that you can choose to comply with new VAT rules:

Option 1: Delivered Duties and Taxes Unpaid (DDU) – buyers are responsible to pay the VAT right after they receive the package.

Option 2: Import One Stop Shop (IOSS) – platforms or fulfillment centers take the responsibility to collect the VAT from sellers before shipping out the packages.

Why are Delivered Duties and Taxes Unpaid (DDU) not recommended?

- The possibility of surprise duties or tax charges when their shipment finally arrives is high. Obviously, that’s a big negative for buyers.

- The risk of customers refusing to pay for their parcel to be delivered is also high, especially if they weren’t aware about this cost when they made the purchase. If customers refuse delivery this could increase the risk of your goods getting lost in transit and cause additional costs.

- Besides GST/VAT, customers may be charged additional fees such as Customer Fee, approximately costing €8 – €22. This even makes the possibility of customers refusing to receive the packages higher, directly affecting the sellers.

Why is the Import One-Stop-Shop recommended?

The Import One-Stop Shop is the electronic portal businesses can use from 1 July 2021 to comply with the new VAT rules on distance sales of imported goods. The IOSS allows to simplify and facilitate the payment and declaration of VAT for goods imported into the EU with a value not exceeding EUR 150.

The advantages of the IOSS service?

The use of the IOSS is optional. However, its benefits for both the sellers and customers also explains why the sellers should choose IOSS.

- Transparency to customers

If you register for the IOSS, IOSS allows you to collect, declare and pay the VAT to the tax authorities instead of making the buyer pay the VAT and possible additional customs fees. Then, the customers can see the total price of the products with VAT-inclusive prices when making purchases.

- Reduced administrative overheads

By registering for the IOSS in only one EU member state, the sellers can do business in the entire EU and don’t have to make VAT declarations in each EU member state. Plus, the use of the IOSS regime can simplify the logistic process as the goods can be imported into any EU member state.

- Quick customs release and delivery time

The IOSS is created to enable the faster delivery time and release of the goods by the customs authorities because no VAT is payable upon importation. Goods sold through non-registered sellers can get more time to pass the border and only be cleared after collecting VAT.

There are two ways to use the IOSS:

- Platforms:

If platforms are responsible for collecting VAT directly per order, IOSS code will be given to sellers. Sellers need to sync the code to the fulfillment center to get the code on shipping labels to manifest that VAT of the shipment has already been paid.

- Fulfillment service:

Several platforms do not support collecting taxes. If sellers fulfill orders through a fulfillment service like Gearment, sellers must pay full VAT tax to the fulfillment service to get the IOSS code for the parcels.

ATTENTION:

- Sellers should inform the customers about the new tax updates and its rates via their listing or website banner to ensure customers understand the use of the IOSS regime and know how much VAT they have to pay.

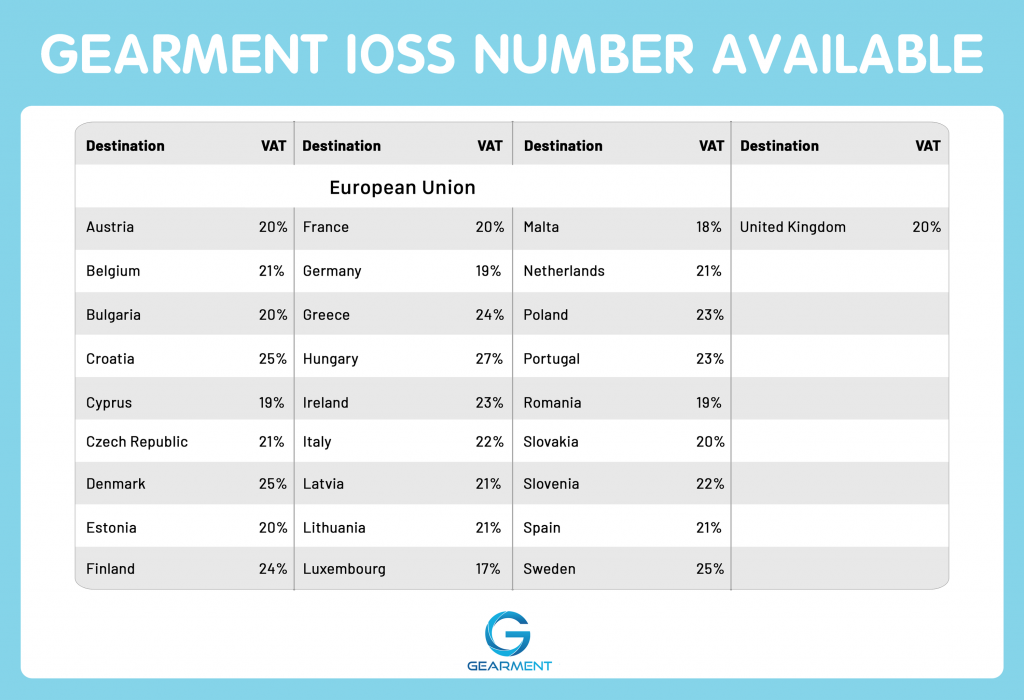

- The VAT rate is the one applicable in the EU Member State where the goods are to be delivered and based on the goods’ value (chèn hình).

- Not all goods imported to the EU have tariffs imposed. For those product categories that have the EU tariffs, a valid tariff code must be included on the shipping labels. The 6 digits of the codes are recommended as they are standard in most countries. There are 3 valid tariff code formats:

- NNNN.NN (6 digit-code)

- NNNN.NN.NN (8 digit-code)

- NNNN.NN.NNNN (10 digit-code)

- Most fulfillment centers including Gearment will provide the tariff code for every product that is imposed a tariff. The code may be sent to the shipping service who then take the responsibility for processing and handling the tariff cost for these orders.

- To be more proactive in finding the tariff code for your products, we recommend several tools that provide enough information:

Don’t hesitate to contact us for 24/7 support:

Inbox fanpage: https://m.facebook.com/GearmentFulfillment/

Email: [email protected]

Gearment website: https://gearment.com

Let share your thoughts with us